sales tax in austin texas 2021

TX Sales Tax Rate. Avalon TX Sales Tax Rate.

Notice Of 2021 Tax Year Proposed Tax Rate For City Of Austin Austintexas Gov

The Austin sales tax rate is.

. Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825. With local taxes the total sales tax rate. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax up to 2 percent for a total maximum combined rate of 825 percent.

Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. Austwell TX Sales Tax Rate. Texas Comptroller Glenn Hegar Announces Revenue for Fiscal 2021 August State Sales Tax Collections AUSTIN Texas Comptroller Glenn Hegar today released totals for fiscal 2021 state revenues in addition to announcing monthly state revenues for August.

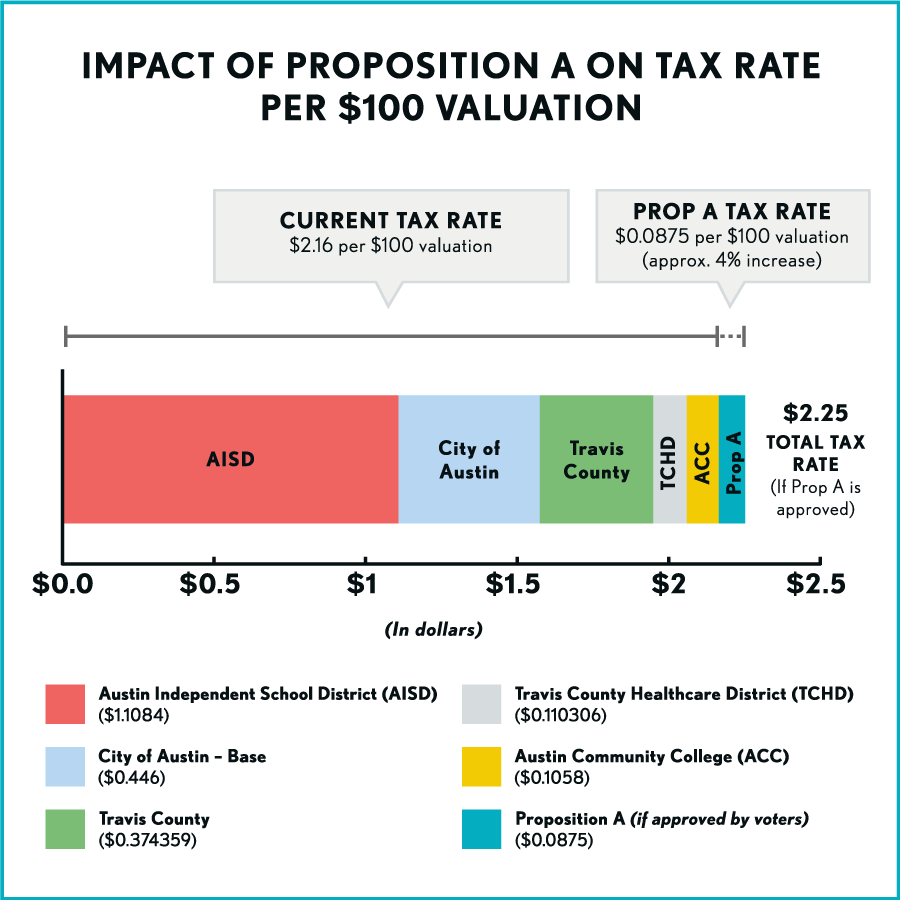

This notice concerns the 2021 property tax rates for City of Austin. What is the Texas sales tax rate 2021. A tax rate of 05542 per 100 valuation has been proposed by the governing body of the City of Austin.

Raised from 625 to 825 Alvarado Venus Grandview Godley Rio Vista and Lillian. The no-new-revenue tax rate would Impose the same amount of taxes as last year if you compare properties taxed in both years. The current total local sales tax.

Austin has parts of it located within Travis County and Williamson County. Texas sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The minimum combined 2022 sales tax rate for Austin Texas is.

ICalculator US Excellent Free Online Calculators for Personal and Business use. What We Do - How It Works. You can print a 825 sales tax table here.

3 rows The current total local sales tax rate in Austin County TX is 6750. Motor vehicle sales and rental taxes 378 million up 130 from April 2020 and up 27 from April 2019. Oil production tax 334 million up 75 from April.

The base state sales tax rate in Texas is 625. The sales tax rate does not vary based on zip code. The Austin County Sales Tax is collected by the merchant on all qualifying sales made within Austin County.

Austin TX Sales Tax Rate. The 2018 United States Supreme Court decision in South Dakota v. For tax rates in other cities see Texas sales taxes by city and county.

The average cumulative sales tax rate in Austin Texas is 825. Groceries are exempt from the Austin County and Texas state sales taxes. Wayfair Inc affect Texas.

Avery TX Sales Tax Rate. General Revenue-related revenue for fiscal 2021 totaled 605 billion up 62 percent from fiscal 2020. The Texas state sales tax rate is currently.

The Arkansas sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. This includes the rates on the state county city and special levels. There is no applicable county tax.

Austin County TX Sales Tax Rate. Austin in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Austin totaling 2. Aurora TX Sales Tax Rate.

Austonio TX Sales Tax Rate. Find your Texas combined state and local tax rate. The no-new-revenue tax rate is the tax rate for the 2021 tax year that will raise the same amount of property tax revenue for the City of.

Has impacted many state nexus laws and sales tax collection requirements. The 825 sales tax rate in Austin consists of 625 Texas state sales tax 1 Austin tax and 1 Special tax. Within Austin there are around 72 zip codes with the most populous zip code being 78745.

Sales Tax In Austin Texas PepWholesale Trade Sales in Austin Hays County TX. Avinger TX Sales Tax Rate. 6 rows The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and.

The County sales tax rate is. The average sales tax rate in Arkansas is 8551. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Method to calculate Austin sales tax in 2021. Motor fuel taxes 325 million up 15 from April 2020 and up 1 from April 2019. We provide sales tax rate databases for.

This is the total of state county and city sales tax rates. Did South Dakota v. The Austin County Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 Austin County local sales taxesThe local sales tax consists of a 050 county sales tax.

Avoca TX Sales Tax Rate. Date Published 2021-04-02 051927Z. Read the full 2021 Approved Tax Rate Notice here.

The Austin County sales tax rate is. 4 rows Austin TX Sales Tax Rate. Raised from 725 to 825.

The state sales tax rate in Texas is 6250. Texas collected the following revenue from other major taxes all of which were up sharply from a year ago due to base effects. This notice provides information about two tax rates used in adopting the current tax years tax rate.

ICalculator US Excellent Free Online Calculators for Personal and Business use. Austin collects the maximum legal local sales tax. This is the total of state and county sales tax rates.

The minimum combined 2022 sales tax rate for Austin County Texas is. 625 percent of sales price minus any trade-in allowance. Licensing Requirements for Sales in Austin.

Simplify Texas sales tax compliance. The Texas sales tax rate is currently. Axtell TX Sales Tax Rate.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

12 Incredible Airbnbs In Austin Texas Wandering Wheatleys

Texas Taxes Economic Development Incentives Txedc

2020 Mobility Elections Proposition A Austintexas Gov

The Value Of Your Travis County Home Has Gone Up A Lot That Doesn T Mean Your Property Taxes Will Austin Monitoraustin Monitor

Best Suburbs Near Austin Texas Newhomesource

What Is The Real Cost Of Living In Austin 2022 Bungalow

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

The Pros And Cons Of Living In Austin Tx Home Money

/static.texastribune.org/media/files/e6a25cb17ab2c3572ed710eb3748ddc0/Housing%20North%20Austin%20AI%20TT%2007.jpg)

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

2022 Cost Of Living In Austin Texas Bankrate

What Are Property Taxes Like In Austin Texas Mansion Global

Why Austin Texas Wants To Be An Autos City Yes Austin Best Hotels In Austin Downtown Austin Austin 6th Street

Texas Shoppers Get Ready To Buy Clothing School Supplies More Tax Free In 2022 Teacher Discounts Tax Free Weekend School Supplies